Category advice

Market Insight

Category advice2023

On average cereal costs 20p per serving and 77% of consumers think that cereal is a good value option or breakfast.

(Mintel Breakfast Cereals Report 2022)

Cereals are brought by 95% of all UK households and is a major category within the shoppers mindset.

(Kantar Worldpanel April 2023)

The strongest periods of demand are when consumers return to routines such as January, post Easter and back to school with a peak in shopper numbers seen at these times.

(Nielsen Answers March 2023)

Cereals is present in 59% of all breakfast occasions.

(Dipsticks Consumer Research Feb 2023)

77% of people like cereal that contributes towards their daily nutrient intake.

(Mintel Breakfast Cereals Report 2022)

Cereal is the No.1 choice in breakfast occasions and in over twice as many breakfasts as toast. Cereal is worth £1.3bn in the latest year.

(Kelloggs Project Landmark – rolling Qtrs' to Q4 2021 & IRI Plussuite data L52 we to 31st October 2022)

Cereal is bought on average up to 21 times per year. An average of 34 boxes bought per buyer per year.

Keep availability in your store high to address consumer demand.

Kantar WPO L52 we to 30th October 2022

In 2022, cereal NPD accounted for over £16m of sales.

Kellogg's have had the biggest NPD launches for the last 5 years. Ensure you are up to date with the newest NPD in the market and are ranging key lines.

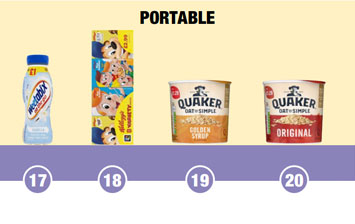

On the go cereals have grown 16% year-on-year – adding £9m to the cereal category.

Make sure you are stocking the top sellers within the Portable category to tap into the on-the-go trend.

IRI Plussuite data L52 we to 31st October 2022

Price Marked Packs

9 of the top 10 selling cereal packs are price marked: 81% of consumers say they are less confusing than non-PMPs and stock PMP packs where possible to make sure pricing is clear and transparent for consumers.

IRI Plussuite data L52we to 31st October 2022

Information correct at time of print.

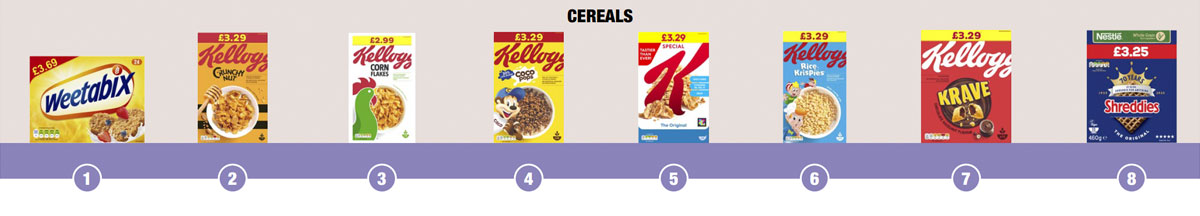

Must Stock Lines

Category advice2023

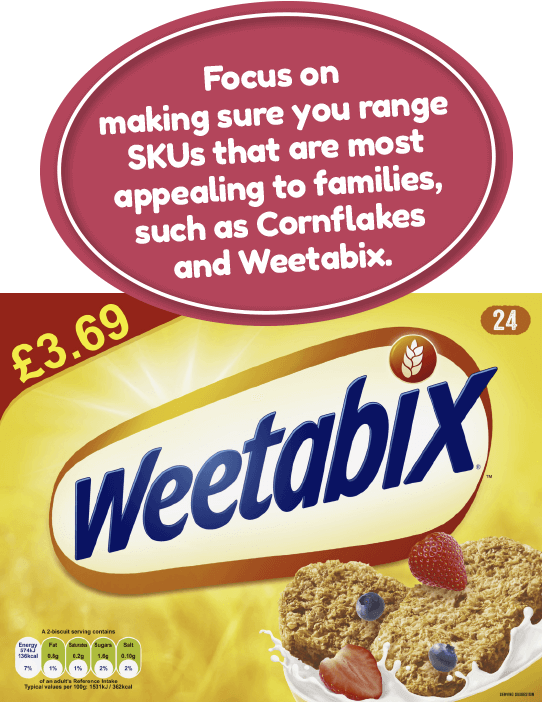

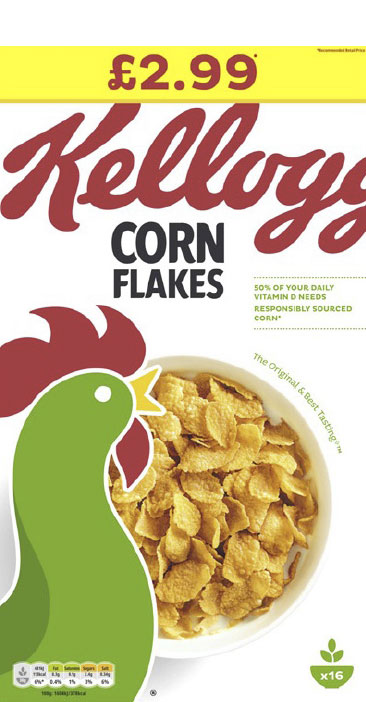

These are the ‘Must Stock’ lines which shoppers expect to see in a convenience store. By stocking these lines, you will be meeting your customers’ needs and therefore they will visit your store again.

We suggest you stock the following range: